A debt ratio represents a financial metric that measures the proportion of debt relative to other financial components such as assets, equity, or income. The ratio shows how much business assets are funded by debt, providing crucial insights into financial leverage and risk exposure.

Debt ratios serve multiple purposes in financial analysis. They help evaluate financial stability, assess borrowing capacity, and determine creditworthiness. Furthermore, these ratios enable comparisons between different entities and track financial performance over time.

Table of contents

What is a Debt Ratio?

The debt ratio measures the proportion of a company’s or individual’s total assets financed by debt. It’s a key indicator of financial leverage, showing how much debt is used to fund operations or purchases relative to total assets. For individuals, the debt to income ratio (DTI) is often more relevant, as it compares monthly debt payments to income, helping lenders assess borrowing capacity.

Understanding these ratios is crucial for financial planning. A high debt ratio might signal over-leveraging, while a low ratio could indicate financial stability. Let’s dive into the different types of debt ratios and how to calculate them.

Public, Onsite, Virtual, and Online Six Sigma Certification Training!

- We are accredited by the IASSC.

- Live Public Training at 52 Sites.

- Live Virtual Training.

- Onsite Training (at your organization).

- Interactive Online (self-paced) training,

Key Components of Debt Ratios

Every debt ratio contains specific components that determine its calculation and interpretation:

Numerator elements: The top portion typically includes various forms of debt, such as loans, credit card balances, mortgages, and other financial obligations. Understanding what constitutes debt in each ratio type becomes crucial for accurate calculations.

Denominator elements: The bottom portion varies depending on the specific ratio type. It might include total assets, equity, income, or other financial metrics that provide context for the debt measurement.

Time considerations: Debt ratios often use specific time periods for calculation. Monthly figures work well for personal finance ratios, while annual data suits business analysis better.

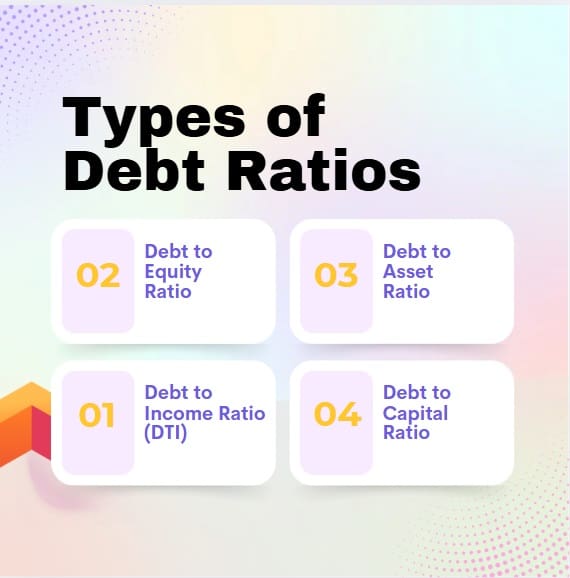

Types of Debt Ratios

Debt ratios come in various forms, each serving a specific purpose. Below, we explore the most common types and their applications.

Debt to Income Ratio (DTI)

The debt to income ratio measures monthly debt payments against gross monthly income. It’s widely used by lenders to evaluate loan eligibility, especially for mortgages. For example, a DTI for mortgage is a key factor in determining whether you qualify for a home loan.

How to Calculate Debt to Income Ratio?

To calculate DTI, use this formula:

DTI = (Total Monthly Debt Payments / Gross Monthly Income) × 100

Example: If your monthly debt payments (e.g., car loan, credit card, student loan) total $1,500 and your gross monthly income is $5,000, your DTI is:

($1,500 / $5,000) × 100 = 30%

A good debt to income ratio is typically 36% or lower, though some lenders, like those offering Wells Fargo personal loan requirements, may accept higher ratios for certain loans.

Debt to Income Ratio for Mortgage

For homebuyers, the debt to income ratio for mortgage is critical. Most lenders prefer a DTI of 43% or less, though FHA loans may allow up to 50% in some cases. Use a debt to income calculator to quickly determine your DTI before applying.

Debt to Equity Ratio

The debt to equity ratio compares a company’s total debt to its shareholders’ equity, reflecting how much debt finances the company relative to owner investment. It’s a key financial leverage ratio for businesses.

Debt to Equity Ratio Formula

Debt to Equity Ratio = Total Debt / Shareholders’ Equity

Example: If a company has $200,000 in debt and $400,000 in equity, the ratio is:

$200,000 / $400,000 = 0.5

A good debt to equity ratio varies by industry but generally falls between 1 and 2. A lower ratio indicates less reliance on debt, while a higher ratio suggests greater financial risk.

Debt to Asset Ratio

The debt to asset ratio shows the percentage of a company’s assets financed by debt. It’s a broader measure of leverage than the debt to equity ratio.

Debt to Asset Ratio Formula

Debt to Asset Ratio = Total Debt / Total Assets

Example: If a company has $300,000 in debt and $600,000 in assets, the ratio is:

$300,000 / $600,000 = 0.5 or 50%

A lower total debt ratio indicates a financially stable company with less dependence on borrowed funds.

Debt to Capital Ratio

The debt to capital ratio measures debt relative to total capital (debt plus equity). It’s useful for assessing a company’s overall financial structure.

Debt to Capital Ratio = Total Debt / (Total Debt + Shareholders’ Equity)

Why Debt Ratios Matter?

Debt ratios provide a snapshot of financial health for both individuals and businesses. Here’s why they’re important:

- For Individuals: A low DTI ratio improves your chances of securing loans, such as mortgages or personal loans, and signals good financial management.

- For Businesses: Ratios like debt to equity and debt to asset help investors and creditors assess risk. A high ratio may deter investors, while a balanced ratio suggests stability.

- For Lenders: Banks and financial institutions use these ratios to evaluate loan applications. For example, the mortgage debt to income ratio is a key factor in home loan approvals.

Understanding these ratios helps you make smarter financial decisions, whether you’re budgeting, investing, or applying for credit.

Also Read: What is Weighted Shortest Job First?

How to Calculate Debt Ratios?

Calculating debt ratios is straightforward with the right data. Below, we outline the steps for the most common ratios.

How to Calculate Debt to Income Ratio

- List Monthly Debt Payments: Include payments for credit cards, student loans, car loans, and mortgages.

- Determine Gross Monthly Income: Use your pre-tax income from all sources (salary, freelance work, etc.).

- Apply the Formula: Divide total debt payments by income and multiply by 100 to get the percentage.

Use a DTI calculator or debt to income ratio calculator for quick results. Many online tools, like a debt-to-income ratio to buy a house calculator, simplify the process.

How to Calculate Debt to Equity Ratio

- Gather Financial Data: Obtain total debt (short-term and long-term liabilities) and shareholders’ equity from a company’s balance sheet.

- Apply the Formula: Divide total debt by equity.

How to Calculate Debt to Asset Ratio

- Collect Data: Find total debt and total assets from financial statements.

- Apply the Formula: Divide total debt by total assets.

For quick calculations, use a debt ratio calculator or leverage ratio calculator available online.

What is a Good Debt to Income Ratio?

A good debt to income ratio depends on the context:

- General Lending: 36% or lower is ideal for most loans.

- Mortgages: Up to 43% is acceptable for conventional loans, though 28%–36% is preferred.

- FHA Loans: Up to 50% may be allowed with strong credit.

To improve your DTI, pay down debt, avoid new loans, or increase your income. Regularly calculate DTI to monitor your financial health.

What is a Good Debt to Equity Ratio?

A good debt to equity ratio varies by industry:

- Low-Risk Industries (e.g., utilities): 0.5–1.

- High-Risk Industries (e.g., technology): 1–2.

A ratio above 2 may indicate excessive borrowing, while a ratio below 0.5 suggests conservative financing.

Tools for Calculating Debt Ratios

Several tools simplify debt ratio calculations:

- Online Calculators: Use a DTI ratio calculator, debt to equity ratio calculator, or debt to income calculator for instant results.

- Spreadsheets: Excel or Google Sheets can handle calculations with basic formulas.

- Financial Software: Tools like QuickBooks or Mint provide built-in ratio calculators.

For example, to calculate DTI in Excel, input your debt and income data, then use:

= (SUM(Debt Payments) / Income) * 100

Improving Your Debt Ratios

If your debt ratios are high, take these steps:

- Pay Down Debt: Focus on high-interest debts like credit cards.

- Increase Income: Take on a side hustle or negotiate a raise.

- Avoid New Debt: Limit new loans or credit card spending.

- Refinance Loans: Lower monthly payments by refinancing high-interest loans.

For businesses, reducing debt or increasing equity through retained earnings can improve leverage ratios.

Also Read: What is Sprint Project Management?

Online DTI Calculators

Wells Fargo DTI Calculator: Calculate your debt-to-income ratio and find out what it means when you prepare to borrow. This tool provides instant calculations and interpretation guidance for mortgage applications.

Bankrate Debt-to-Income Calculator: Professional-grade calculators offer comprehensive analysis with detailed breakdowns and recommendations for improvement.

Mortgage-specific calculators: It’s as simple as taking the total sum of all your monthly debt payments and dividing that figure by your total monthly income. Specialized mortgage calculators consider housing-specific factors for accurate pre-approval assessments.

Common Mistakes to Avoid

When working with debt ratios, avoid these pitfalls:

- Ignoring Small Debts: Include all debts in DTI calculations, even minor ones.

- Misinterpreting Ratios: A low ratio isn’t always better; some debt can fuel growth.

- Neglecting Industry Norms: Compare business ratios to industry standards.

- Inaccurate Data: Double-check financial statements for accuracy.

Final Words

Debt ratios, including debt to income, debt to equity, and debt to asset ratios, are essential tools for assessing financial health. By understanding and calculating these ratios, you can make informed decisions about loans, investments, or business strategies. Use online calculators, monitor your ratios regularly, and take steps to improve them for a stronger financial future.

Frequently Asked Questions for Debt Ratio

What is a good debt-to-income ratio for mortgage approval?

Most lenders prefer a back-end DTI ratio below 43% for conventional mortgages, with front-end ratios below 28%. However, government-backed loans like FHA may accept ratios up to 57% with compensating factors. The exact requirements depend on your credit score, down payment, and other financial factors.

How do I calculate my debt-to-equity ratio?

Calculate your debt-to-equity ratio by dividing total liabilities by shareholders’ equity. For businesses, use balance sheet figures. For personal finance, divide total debts by net worth (assets minus liabilities). This ratio shows how much debt you’re using compared to equity financing.

What’s the difference between front-end and back-end DTI ratios?

Front-end DTI includes only housing-related expenses (mortgage, taxes, insurance) divided by gross income. Back-end DTI includes all monthly debt payments plus housing costs divided by gross income. Lenders evaluate both ratios, with back-end DTI being more comprehensive.

Can I improve my debt ratios quickly?

Yes, you can improve debt ratios through debt consolidation, increasing income, or paying down existing debts. However, sustainable improvement requires consistent effort over time. Focus on high-interest debt first and avoid taking on new debt during the improvement process.

What debt-to-asset ratio is considered healthy?

For businesses, debt-to-asset ratios below 60% are generally considered healthy, though this varies by industry. For individuals, the ratio depends on asset types and financial goals. Real estate investments might justify higher ratios than liquid asset portfolios due to different risk profiles.