Table of contents

Estimated reading time: 3 minutes

What Is Profitability Index?

The Profitability Index or PI in bussiness, also known as the Profit Investment Ratio (PIR) or the value investment ratio (VIR), is a financial metric used to evaluate the potential profitability of an investment or project in business. It measures the relationship between the present value of future cash flows and the initial investment required for the project. Calculating the PI helps in assessing whether an investment opportunity is worthwhile by considering the returns generated relative to the costs incurred, making it a valuable tool in financial decision-making processes.

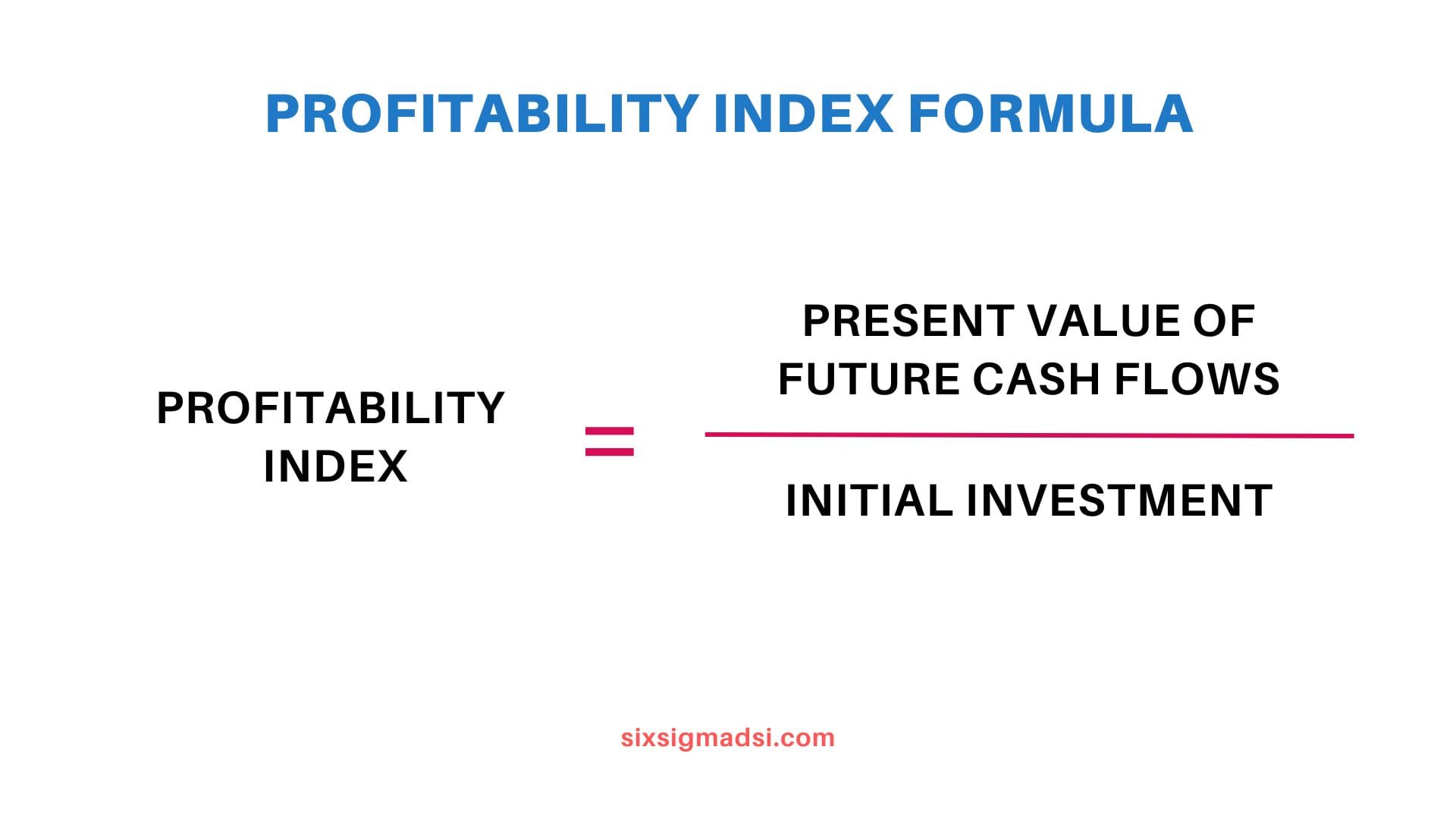

The formula for calculating the Profitability Index is:

Where can I use it?

The Profitability Index, (PI in bussiness) and financial contexts where investment decisions are being made. Some of the key areas where you can use the Profitability Index include:

- Capital Budgeting and Investment Analysis: When evaluating multiple investment projects, the PI helps in comparing and selecting the most profitable project by considering the present value of cash flows relative to the initial investment.

- Business Expansion or Capital Projects: Companies often use the PI to assess the viability of expanding operations, acquiring new assets, or implementing new projects. It aids in determining the potential return on investment and helps prioritize among various options.

- Public Sector Projects: Governments and public institutions use the PI to assess the feasibility of public infrastructure projects, such as building roads, bridges, schools, or hospitals. It helps in prioritizing projects based on their economic benefits.

- Resource Allocation: Within a company, when deciding where to allocate resources among different departments or divisions, the PI can assist in evaluating the potential profitability of each option.

- Evaluation of Long-Term Investments: Whether in real estate, machinery, technology, or other long-term assets, the PI can be used to gauge the profitability of these investments and make informed decisions about their implementation.

- Loan or Financing Decision: Lenders and financial institutions might consider the PI when assessing loan applications or financing for projects, as it provides insight into the potential for generating returns to cover debt obligations.

- Evaluation of Investment Funds: Investors and fund managers might use the PI to evaluate the potential profitability of investment portfolios or funds, comparing the present value of expected returns against the initial investment.

Remember, while the Profitability Index is a valuable metric, it should not be the sole determinant in decision-making. It’s crucial to consider other factors such as risk, market conditions, strategic alignment, and qualitative aspects alongside the PI to make well-informed investment choices.